1123

89

23

1123

12441

13

DEPENDABILITY

52200

23

Tp

Tp

TRANSPARENCY

52200

23

H

H

HONESTY

12441

41

Dp

Dp

DEPENDABILITY

Welcome to Element Efficiency Advisors,

We take pride in guiding homeowners to the most financially efficient path for optimal home efficiency and energy independence. We are passionate about empowering homeowners with the knowledge and tools they need to make informed decisions about their energy future. Our mission is to cut through the noise and provide clear, transparent, and unbiased information about the Solar Industry, Solar Financing, Government Incentives, and the Most Important Variables to Determine if Solar is a good fit for you. We believe that every homeowner deserves access to reliable and accurate information about solar energy without the pressure of a sales pitch. We aim to help you understand the science behind the tech, the benefits, and the potential pitfalls of solar energy so you can make the best decision for your home and your future.

What Makes Us Different: Educational Approach: Unlike traditional solar companies, we focus on education rather than sales. Our team of experts is dedicated to providing you with comprehensive information on solar energy, from design and financial considerations to understanding the track records of various solar companies. We use public record data from municipality, county, and state websites to ensure our information is accurate and unbiased.

Transparent, Honest & Dependable: We pride ourselves on transparency. Our fixed upfront bottom dollar pricing means no hidden fees or surprises. We have also removed the 3-day cancellation policy to give you peace of mind. Our industry-leading contractual guarantees and workmanship warranties are designed to protect your investment. We work with contractors who have the best workmanship and warranty service track records in the industry. We provide data to support our claims, giving you confidence in your decision to go solar.

SCHEDULE CONSULT

A better process creates...

a better experience.

- Get educated not sold

- Just the facts No sales tactics

- No Three Day Cancellation Policy

- Industry Leading Vetted Contractors

- Up Front Bottom Dollar Pricing.

- Sources and Data Provided

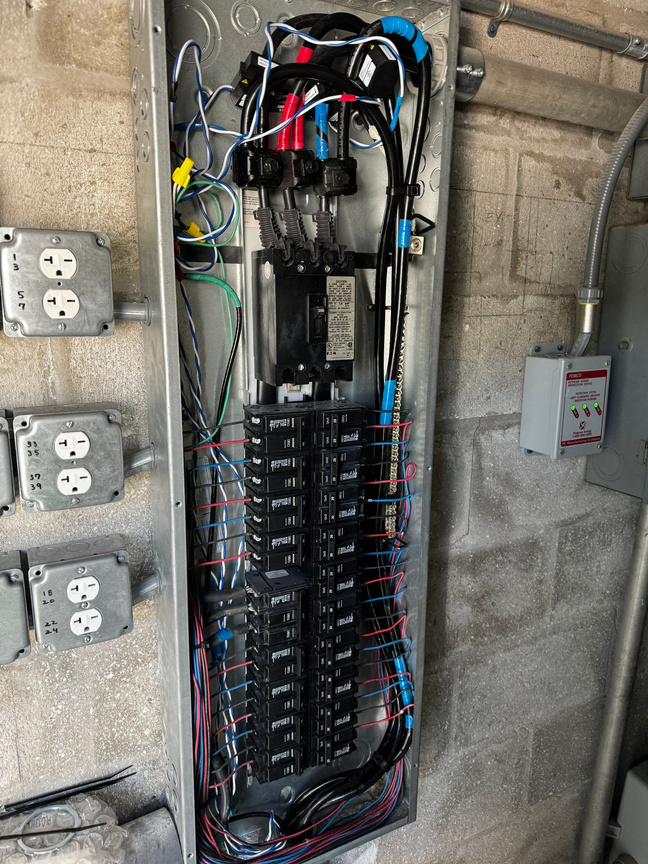

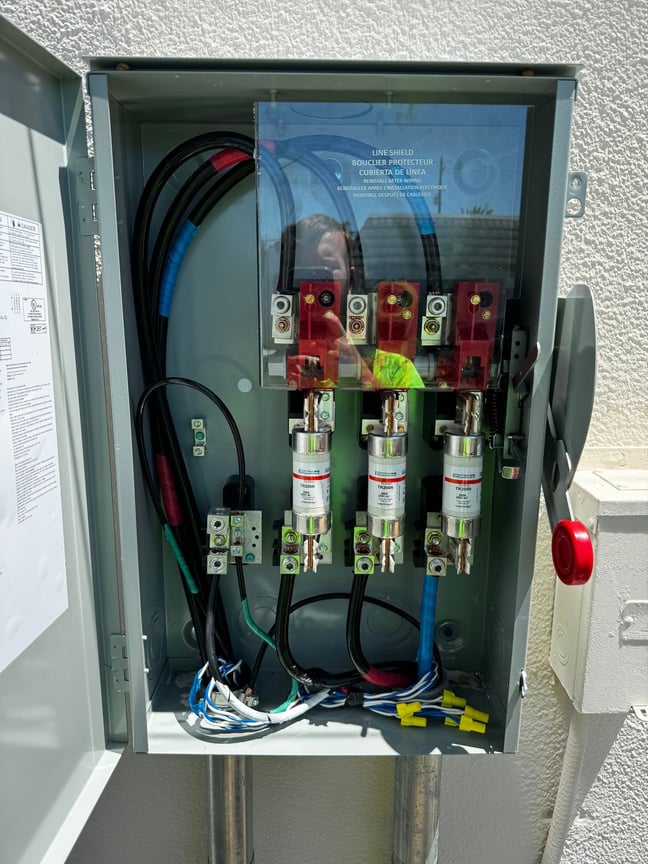

FEATURED Project

FEATURED Project

LAW OFFICE MIDTOWN ST. PETERSBURG, FL June 2024

micro-inverter

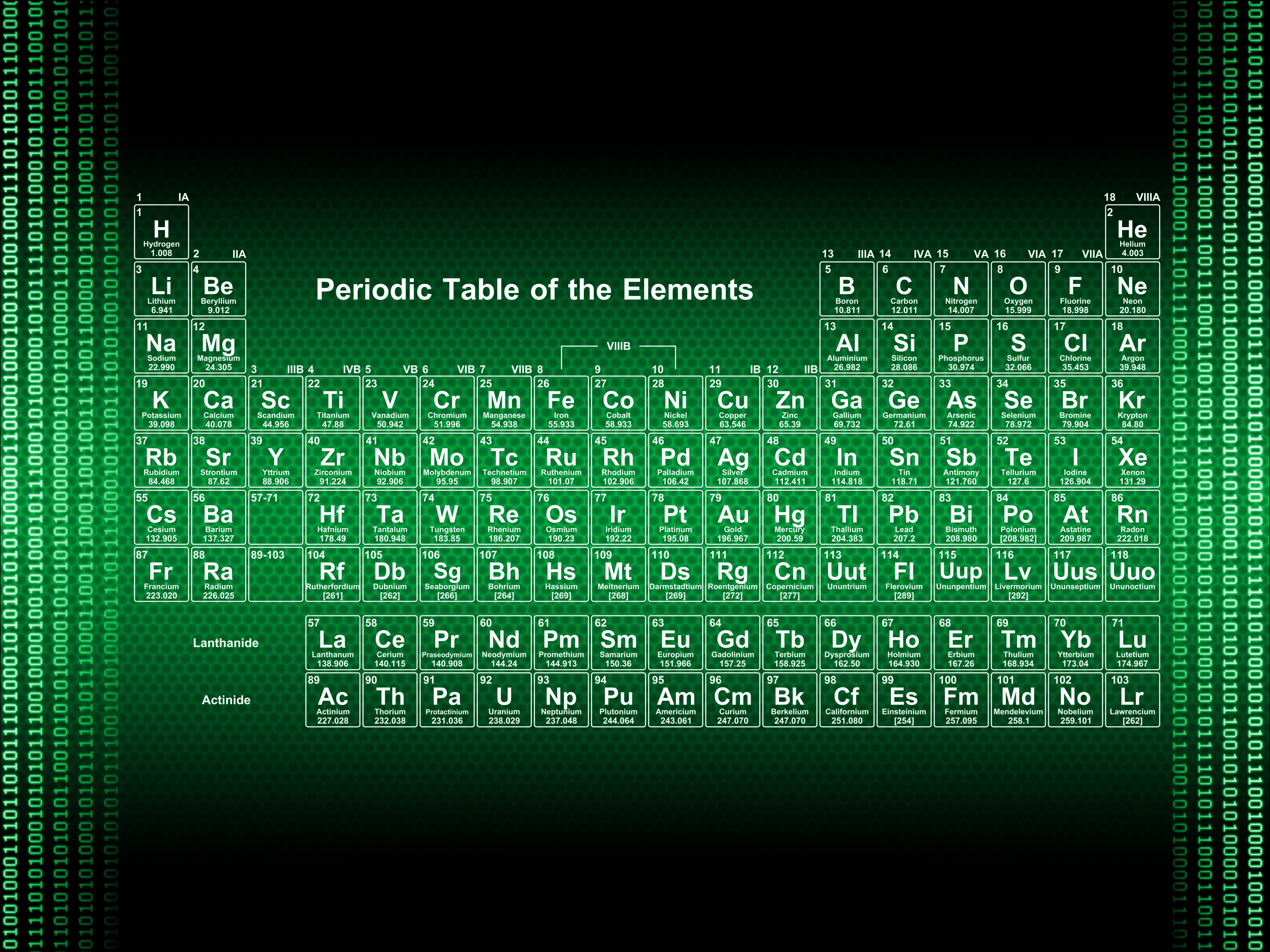

Solar panels create energy through the photovoltaic effect, where sunlight is converted into electricity. Each solar panel is made up of multiple solar cells, typically made of silicon, that absorb sunlight and generate direct current (DC) electricity. However, this electricity is not in a form that can be used in most homes and businesses without conversion.

This is where microinverters come into play. Microinverters are attached to each individual solar panel in a solar array. Their primary function is to convert the DC electricity produced by the solar panels into alternating current (AC) electricity, which is the type of electricity used in most homes and businesses.

With net metering, they install a bi-directional meter that shows what you consume and what you produce. In most cases the electricity generated by your solar system is sent to the grid, allowing you to earn credits for the energy you produce which offsets your households energy consumption .

One common misconception about solar is that solar alone makes you no longer dependent upon the grid. You must add a battery backup and storage to your solar system for true energy independence. Battery storage allows you to store excess energy generated during the day and use it when the sun goes down or in case of a power outage, ensuring that you have power even when the grid is down.

SIZING YOUR SYSTEM

Analyze Your Consumption

The first step is to calculate what your annual KWh consumption is most power bills will provide the last 13 months of consumption. For example, Duke Energy has a chart on the front page of the bill that shows the current month compared to the same month last year. Below that, it has the last 12 months total. The annual number of KWh is what you are going to be looking for. If that is not on your bill, simply collect the last 12 months of electric bills to determine your annual kWh usage.

Efficiency of Current Appliances

Older HVAC systems, pool pumps, and hot water heaters are significantly less efficient than newer models. If you base the size of your solar system on the energy needs of these older appliances, you may soon replace them. This could result in unnecessary costs associated with purchasing and installing additional solar panels. A more cost-effective approach is to upgrade to more energy-efficient appliances, reduce the number of panels needed, and potentially include the cost of the appliances in the solar loan if necessary. Upgrading the appliances is, without question, the most cost-effective approach as the appliances will eventually need to be replaced but are also almost always less money upfront than the additional panels.

- HVAC Systems (SEER Ratings) -Fifteen years ago, the average SEER (Seasonal Energy Efficiency Ratio) rating for residential HVAC systems in the United States was around 10 to 12 SEER. Many existing HVAC systems then fell within this range, with some older systems even lower than 10 SEER. Today, the range of SEER ratings available has expanded significantly. Standard units now offer SEER ratings as high as 26, while mini-split systems can reach SEER ratings of up to 38. The minimum requirement for new units is 14 SEER. If you are replacing an older unit that was a top-of-the-line 12 SEER system 15 years ago with a more middle-of-the-road 18 SEER system today, you should save around 50% or more energy with the upgrade.

- Pool Pumps (Single Speed vs. Variable-Speed) - Single-speed pool pumps operate at a fixed speed, typically running at maximum capacity regardless of the pool's actual needs. They are less energy-efficient compared to variable-speed pool pumps. Variable-speed pool pumps, also known as "whisper flow" pumps, can adjust their speed based on the pool's requirements, resulting in significant energy savings. The exact percentage of energy savings can vary depending on factors like pool size and usage. In general, variable-speed pool pumps can save up to 70-80% in energy costs compared to traditional single-speed pumps.

- Hot Water Heaters - Tankless water heaters are more energy-efficient than traditional storage tank water heaters. They heat water on demand, reducing standby energy losses. Tankless water heaters can be up to 34% more energy-efficient than traditional tank water heaters.

Leakage Loss Inspection

You can pay for an energy audit to see what you lose on conditioned air escaping your home, but we don't think that's necessary. These two steps will provide a solid assessment of where you’re at. The first is an insulation check. Simply poke your head in the attic to assess if you need to add some insulation. If you need a reference, a quick Google search will provide several. Next, get a laser thermometer and walk the exterior of your home, checking windows and around the large attic for cooler air escaping. You are in luck if you are not looking to add new windows. Most of the time, a tube of caulk will be all that you need.

Is Your Property Solar Friendly?

- Location: Sunlight availability and climate conditions - A common question we get is how your software can accurately project system production. Solar proposal systems use the latitude and longitude of your home location and calculate the weather based on the last 25-50 years of weather patterns to determine how many sun hours you can expect in your location. It is important to understand that a sun hour is when the sun's intensity is an average of 1,000 watts of photovoltaic power per square meter, which will only occur with the direct overhead sun.

- Roof Design - The most important factor in ensuring maximum production is the direction of your panels. This will be determined by where you are located in relation to the equator. So, in the United States, south-facing panels are the best, and the losses are significant: East and west-facing panels lose roughly 15%, and north-facing panels lose 30%.

Evaluating

Contractors

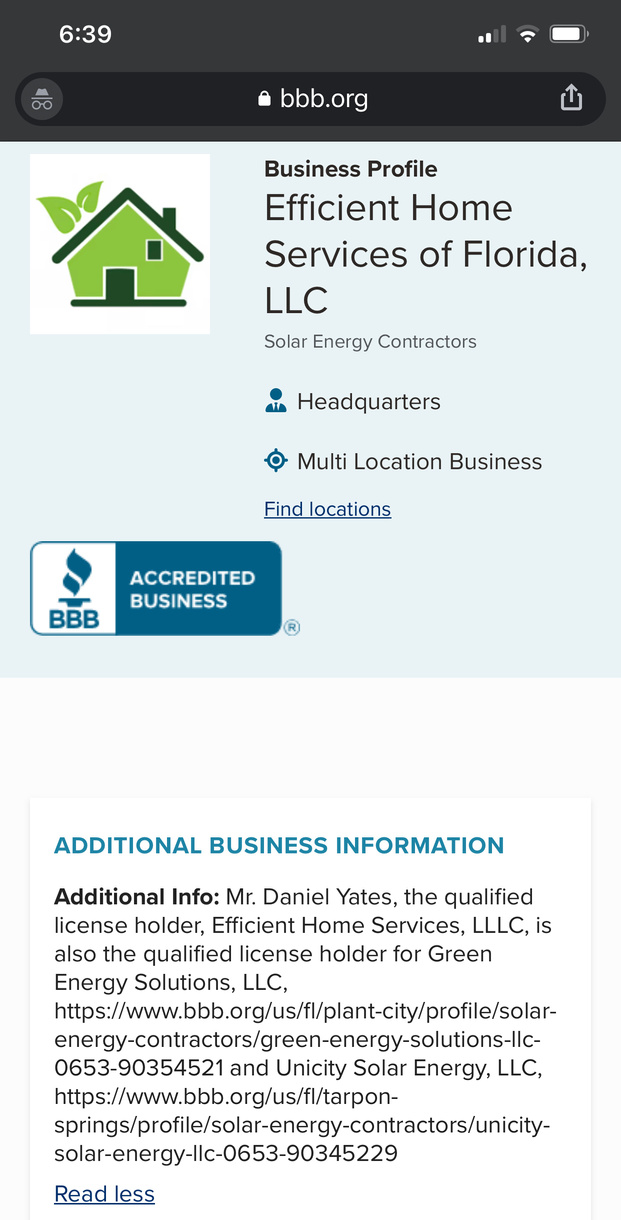

IDENTIFY THE OWNERS

Look up the company FL division of corporations www.sunbiz.org (link). It will have a list of companies in alphabetical order if you see several versions of the same name and owners, that is a red flag as it is a common practice to avoid liabilities if the company had financial problems. Once you find the active entity, take note of the date filed, which reflects how long the corp has been in business, and write down the officers' names as one of them should be your qualifying licensed electrical contractor. Then, scroll down to the bottom of the page and look at the filings for name changes and ownership changes as it is common for companies to buy a shell company to appear to have been in business longer .

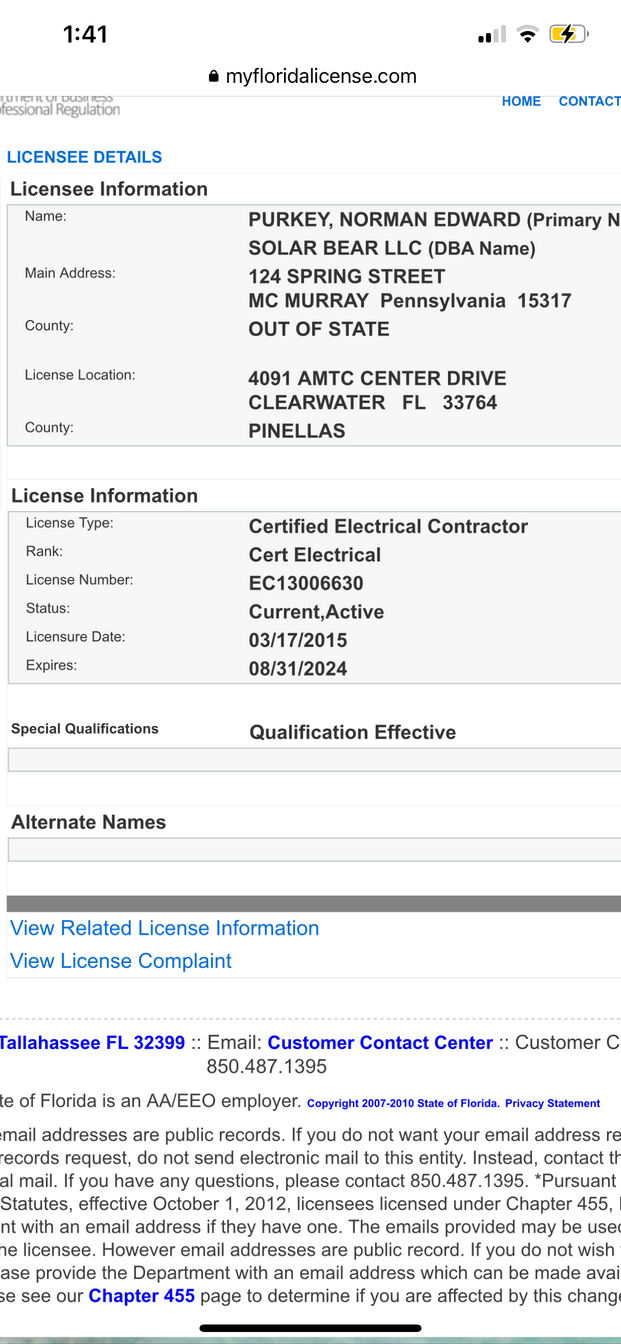

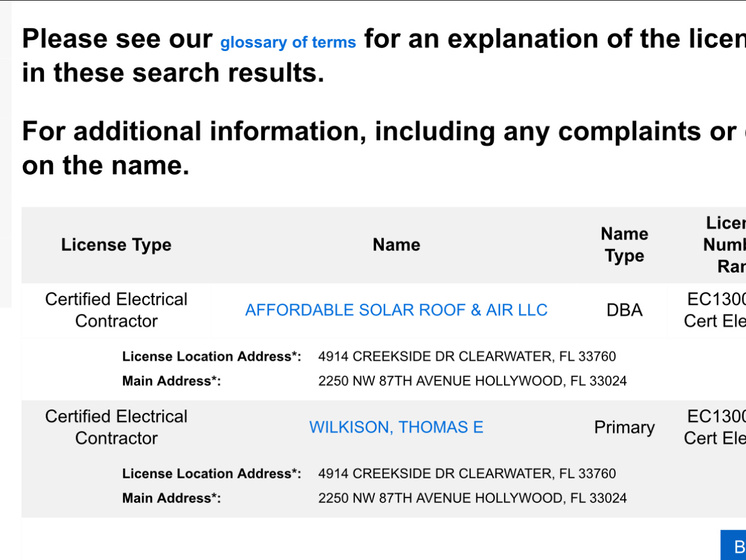

VERIFY LICENSING AND INSURANCE

Step two is to verify that they are licensed and insured, which can be done via the Department of Business and Professional Regulation. Verify that the licensee is an owner via the DBPR( link below for convenience). This is important because a lot of companies are operating under the license of a non-owner. They pay the licensee a monthly stipend, then put a bond up to protect the licensee from financial liability, and all of the complaints stick to that license, so if they burn a license, they move on to the next licensee. Essentially, they are operating unregulated. To start our vetting process, the licensee must own the company. A direct correlation exists between the quality of workmanship, overall professional standards, and licensee ownership.

myfloridalicense.com - Verify FL License (click)

EHS

EHS

SOLAR BEAR

SOLAR BEAR

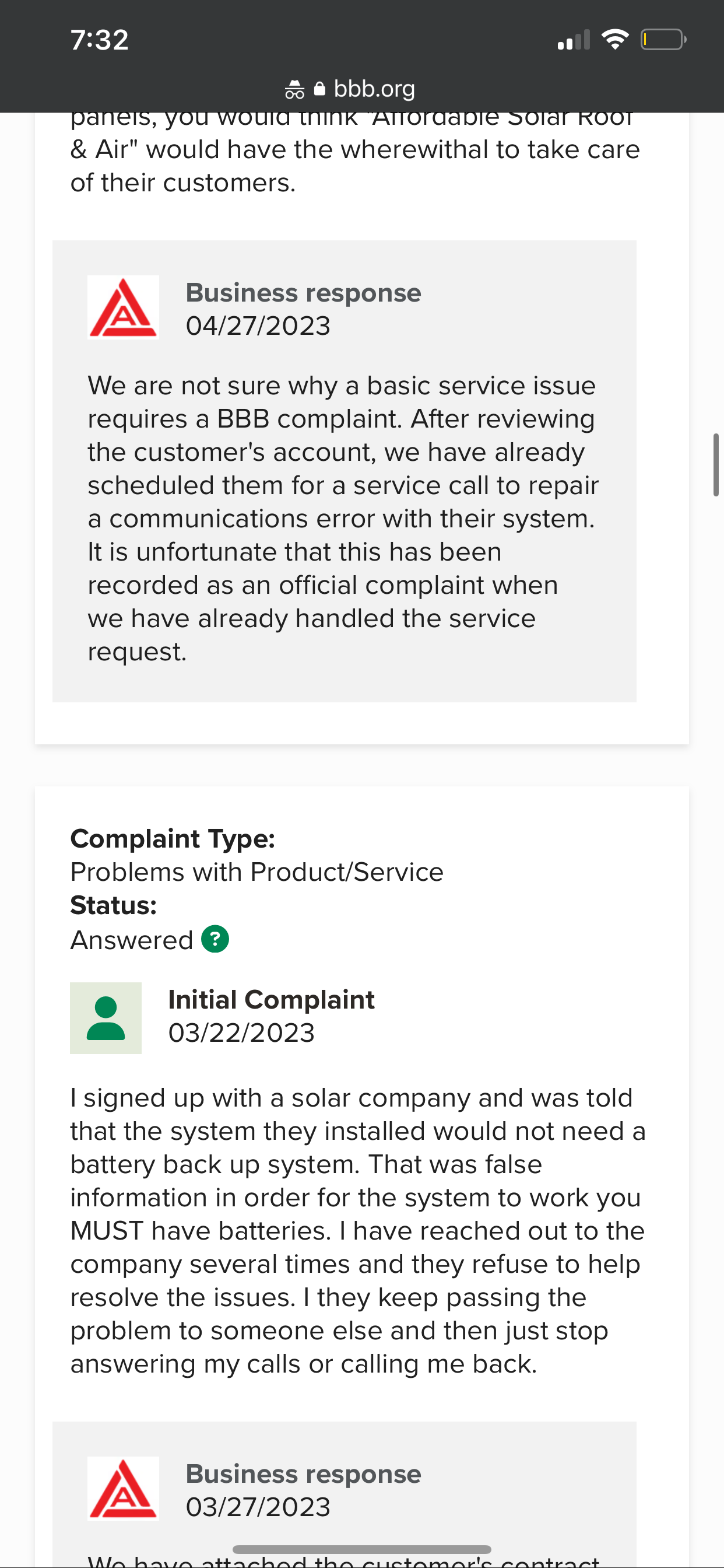

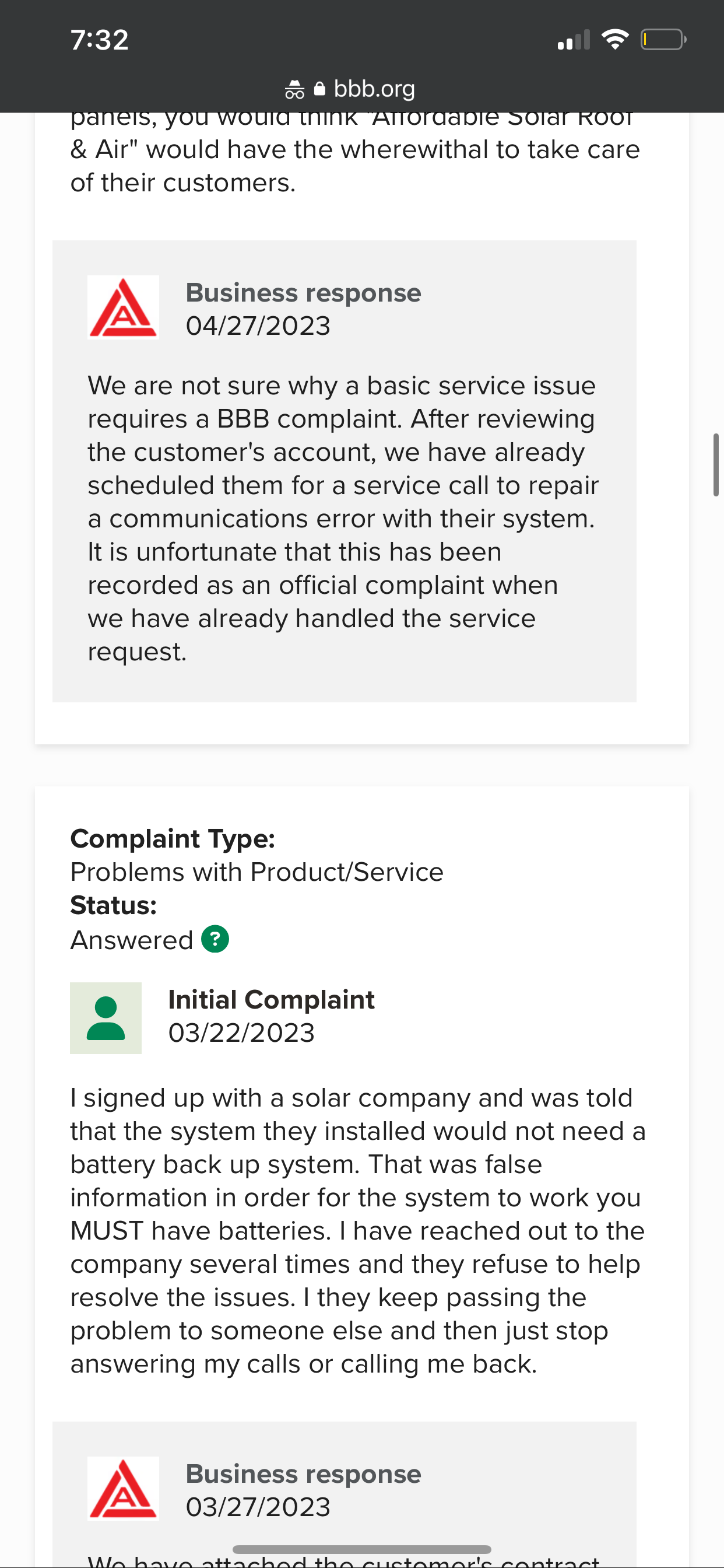

AFFORDABLE

AFFORDABLE

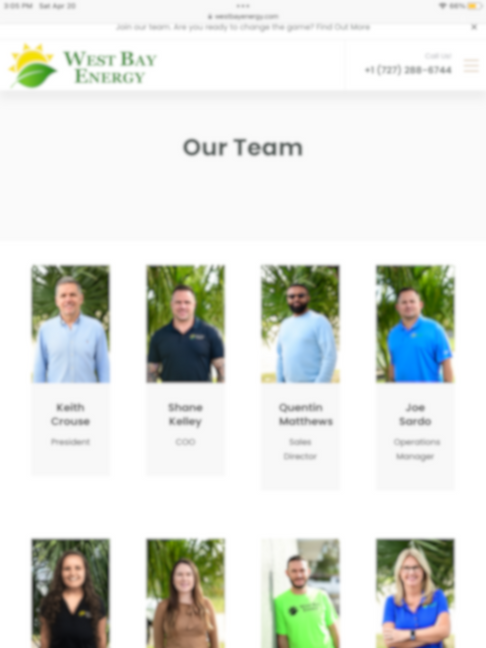

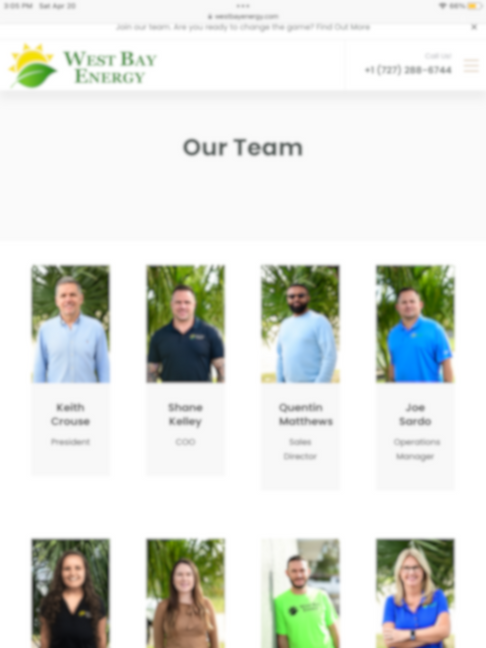

Company Websites

We understand this sounds crazy. However, you are looking for photos of things like the office, warehouse, employees or employee directory, or even executive bios. These companies claim to have been in business for 10 years or more and that they do everything in-house by their employees. Below, you can see photos from our Power Partners. Real photos of these things exist, but the self-proclaimed Industry leaders have only stock photos...

Power Partners

CUSTOMER

SERVICE MANAGER

1/4

lement

efficiency advisors

Ratings and Reviews

When it comes to evaluating companies, it's important to understand that ratings and glowing reviews have no value as they are more often than not manipulated or fake. The only things that should hold any weight are negative reviews and complaints. Positive reviews on platforms like Google, Solar Reviews, Energy Sage, and even the beloved Better Business Bureau are not verified, and the ratings are not calculated in a way that paints an accurate picture. For example, the BBB told CNNMoney in a written statement that the BBB ratings do not guarantee a business's reliability or performance. Customer Reviews are not used to calculate the BBB Letter Grade Rating. They clarified that "BBB's Rating Represents the BBB’s about a business's trustworthiness and how it is likely to interact with its customers." The reliability of all these platforms has been destroyed by the revenues created for generating leads and the businesses they hold accountable for becoming their biggest customers. Sun Run has pending gov action from the FTC for market conduct and 4172 complaints that were reported to and verified by the BBB, yet when you look them up, they are A+ rated and 4.5 stars.

How does the Better Business Bureau make money? BBB is a “nonprofit” entity who sells ratings, accreditations and advertisement space to other companies. BBB makes money from small and big businesses. Typically, the larger your business, the more money you pay BBB for listings and ads. This is how they make their money.

Lead generation companies for contractors

From sources across the web

HomeAdvisor

Google Business Pro

SOLAR REVIEWS

Bark

Buildzoom

Houzz

Yelp

Bing Places

Angi’s List

Better Bussiness Bureau

ConstructConnect

SolarReviews

https://www.solarreviews.com › solar-leads

SolarReviews is the largest supplier of sales leads to the residential solar industry. Learn how buying solar leads can help your business succeed today.

Angie's List

https://office.angi.com › solar › advertising

pros in Your Area. Sign up now. Grow your online...

Homeowners are searching for

solar

Homeowners are searching for

solar companies that are BBB accredited

efficiency advisors

Credit vs. Rebate

This is not a tax rebate that automatically comes back to you when you file, and it is crucial to have an accurate expectation of the timeline for receiving the solar investment tax credit (ITC). If you're financing a solar system. This is because most solar loans are set up assuming you will reinvest the credit or pay down the loan with the honor. If you don't receive the credit as expected, your payments will increase significantly in month 19, which may not fit your budget. This can cause a real problem, leading to missed payments or even defaulting on the loan. So, it's essential to understand the specific timeline and eligibility criteria for claiming the ITC to ensure you can budget accordingly and avoid any potential financial issues.

Tax Credit for Homeowners

The Federal Investment Tax Credit (ITC) for homeowners and the Inflation Reduction Act recently signed by President Biden are tax credits for eligible solar photovoltaic (PV) systems. This credit can also be applied to other energy-efficient improvements.

Eligibility Requirements

Eligible solar PVs must have broken ground during the tax year and generate electricity for a dwelling located in the United States. Your clients must also meet the following requirements:

- The homeowner must own the solar PV system. Financed systems qualify, but leased systems do not.

- The solar PV system is new or in use for the first time.

Eligible Expenses

- Solar PV panels that are used to power an attic fan.

- Site Prep, including roofing and tree work

- Contract labor for site prep, installation, assembly, permit fees, etc.

- Wiring and mounting equipment

- Energy storage devices charged by solar panels

- Sales tax on panel purchases

Determining How it Applies to Your Household

The Inflation Reduction Act expands the credit for tax years 2022 through 2032 to a credit of 30% of qualifying costs. This tax credit is unique in the fact that there are no maximum credit amounts or threshold limitations. Form 5695, Part I, must be completed with the Federal Form 1040 in order to claim the credit.

Example: An individual or business purchases a $50,000 system. He has a solar tax credit credit of $15,000 after he files his taxes and receives a tax refund of $5,000. Their remaining tax liability would be $10,000 ($15,000 - $5,000). In this case, the available tax credit is $10,000, which matches the remaining tax liability. Therefore, they can claim the full credit in one year. They would apply for the solar investment tax credit and receive the entire $10,000 as a credit toward their taxes owed or as a refund if they had taxes withheld. However, if their return was $10,000 and their remaining liability was $5,000, they would only receive the $5,000 in the first year, and the other $5,000 would roll forward to the next year.

Unused Tax Credits

This credit is nonrefundable, meaning your clients won’t get a refund for credit amounts that exceed their tax liability. However, the credit will carry forward into the next tax year.

Other Key Information

- Solar panels don’t need to be located on the roof to qualify.

- If your client has a home office, the credit computation becomes more difficult. If less than 80% of the solar PV system cost is a residential expense, the IRS only allows the percentage that relates to the residential spending to be used in the credit calculation. The portion that is a qualifying business expense follows commercial ITC rules on Schedule C, which are discussed below.

- Your client doesn’t necessarily need to be a homeowner to claim the credit. This commonly arises in a tenant-stockholder relationship in corporations and for condo owners.

element.

design lab

CUSTOM SOLUTIONS

Going solar is too often associated with a drop-off in visual appeal. We offer custom solutions that are stylish and functional. While it does take a little vision and additional planning, custom solutions can be more financially efficient in some cases. We take pride in creating Tailor Made Solutions that fit our client's vusion.

efficiency advisors

efficiency advisors

THE SUNSHINE CITY IS ELECTRIC...

SUNSHINE SKYWAY BRIDGE ST. PETERSBURG, FL SUNSHINE AND LIGHTNING CAPITAL OF THE WORLD

THE SUNSHINE CITY IS ELECTRIC...

SUNSHINE SKYWAY BRIDGE ST. PETERSBURG, FL SUNSHINE AND LIGHTNING CAPITAL OF THE WORLD

SCHEDULE CONSULT

Contact

P.727.656.5082

E.info@elementefficiency.com